Hello VMM readers. I bought into VMM as soon as the acquisition was announced in 2023 and it was a good earner for me for FY24. If you know how to use the advanced search function on Hot Copper, you can find I put a lot of work into trying to understand VMM. It was fun with all the regular posters. Back during the FY24 financial year, there was little understanding of these novel clay hosted rare earth deposits. Fortunately for some (particularly for those who cleaned up on MEI) & unfortunately for others (i won't mention to amount of MEI options I dumped at a low price after the MEI acquisition), the ASX allows companies to use the term "world class" despite what appears the non existence of any actual world class clay hosted REE mine. My sense is the term "world class" is best reserved for Tier 1 assets; the type of assets BHP or RIO quickly takeover.

So what is my opinion about VMM's predictable announcement today in relation to the share price?

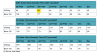

Below is a spreadsheet, which contains four scenarios. I had to introduce the parameter of "cashflow per share (which adds back the deprecation)"; instead of 'earnings per share' (which includes depreciation loss) because the worst scenario would be uneconomic using "earnings per share" (because the share capital would be diluted into uneconomic status).

I was pondering after completing my spreadsheet (using "cashflow per share") whether or not to buy some VMM shares because VMM is hypersensitive to movements in REE prices. I guess the VMM share price is close to the bottom. I'd rather be holding VMM than MEI.

The above said, I do not personally believe any of these projects will be producing low grade REE from clay at less than US$10/kg. I don't care if clay is clay. Its low grade and low grade is low grade.

However, let us assume I am wrong & the numbers in today's announcement are realistic. What we have below is four scenarios:

1. Worst case of initial US$373 CAPEX, per the announcement. At what I personally regard is a current US$23/kg basket price and the VMM US$8.80/kg OPEX, using the parameter of "cashflow per share" to raise 40% of the CAPEX in Equity, this capital raising can be done at 20 cents with a 60 cent share price target for the large investors.

2. VMM CAPEX case of initial US$287 CAPEX, per the announcement. At what I personally regard is a current US$23/kg basket price and the VMM US$8.80/kg OPEX, using the parameter of "cashflow per share" to raise 40% of the CAPEX in Equity, this capital raising can be done at 54 cents with a $1.63 cent share price target for the large investors.

3. Worst case CAPEX & VMM Spot Price case of initial US$373 CAPEX, per the announcement and US$30/kg basket price and the VMM US$8.80/kg OPEX, using the parameter of "earnings per share" to raise 40% of the CAPEX in Equity, this capital raising can be done at 54 cents with a $1,62 cent share price target for the large investors.

4. VMM CAPEX & Spot Price case of initial US$287 CAPEX, per the announcement and US$30/kg basket price and the VMM US$8.80/kg OPEX, using the parameter of "earnings per share" to raise 40% of the CAPEX in Equity, this capital raising can be done at 99 cents with a $2,98 cent share price target for the large investors. If I used "cashflow per share" for this last scenario, it would be capital raising at $1.50 with long term target of $4.52.

The MAIN PROBLEM with MEI & VMM is the 70% payability on the final product and the purported low OPEX. This meanings the economics are wildly affected by changes in REE prices. For example, if REE prices fell by a mere 20% (which is the actual late 2004 Pr-Nd price lows) , Scenario 1 would be wiped out, imo, to uneconomic. The main problem is not making profit but raising any probable Equity Portion of the CAPEX. BKT is currently a company with very high CAPEX, weak graphite price, finance already approved but raising the Equity portion of the CAPEX appears will massively dilute the share capital into negligible returns for investors.

IN SUMMARY, based on today's study, VMM can easily improve if the basket price reaches what I regard as US$30/kg; a rise of 30%. This said, REE prices appear to have already risen 20% (eg. from $46 to $54.72) from the most recent bottom.

- Forums

- ASX - By Stock

- VMM

- My opinion on VMM

VMM

viridis mining and minerals limited

Add to My Watchlist

3.51%

!

29.5¢

!

29.5¢

My opinion on VMM

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

29.5¢ |

Change

0.010(3.51%) |

Mkt cap ! $25.14M | |||

| Open | High | Low | Value | Volume |

| 29.0¢ | 31.0¢ | 27.5¢ | $207.8K | 705.6K |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 33776 | 29.0¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 29.5¢ | 44932 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 33776 | 0.290 |

| 1 | 35000 | 0.285 |

| 2 | 75000 | 0.280 |

| 3 | 48232 | 0.275 |

| 4 | 155000 | 0.270 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.295 | 44932 | 1 |

| 0.300 | 44036 | 1 |

| 0.305 | 20000 | 1 |

| 0.330 | 20000 | 1 |

| 0.335 | 35000 | 1 |

| Last trade - 16.10pm 23/04/2025 (20 minute delay) ? |

Featured News

| VMM (ASX) Chart |